Labour productivity in Malaysia is significantly higher than in neighbouring Thailand Indonesia the Philippines or Vietnam due to a high density of knowledge-based industries and adoption of cutting-edge technology for manufacturing and. DTAs reduce tax impediments to cross-border trade and investment and assist tax administration.

Pdf Land Tax Administration And Practice In Malaysia A Review On Institutional And Governance Issues

Therefore it should come as no surprise that double taxation presents quite a costly situation.

. Purchase of basic supporting equipment for disabled self spouse child or parent. In order to avoid potential transfer pricing penalties one avenue available to companies may be to obtain an advance pricing agreement APA with the IRS unilaterally or with the IRS and another tax authority bilaterally covering inter. Where an individual is a resident of both countries the avoidance of double tax agreements DTA generally contain.

Double taxation treaties are agreements between 2 states which are designed to. 1996 Malaysia-UK Double Taxation Agreement as amended by the 2010. The Income Tax Department NEVER asks for your PIN numbers.

If you have problems opening the pdf document or viewing pages download the latest version of Adobe Acrobat Reader. Installment Agreement Request POPULAR FOR TAX PROS. New Zealand has a network of 40 DTAs in force with its main trading and investment partners.

Therefore you should consult the tax authorities of the state in which you live to find out if that state taxes the income of individuals and if so whether the tax applies to any of your income or whether your income tax treaty applies in the state in which you live. African Congress Mission. AmendFix Return Form 2848.

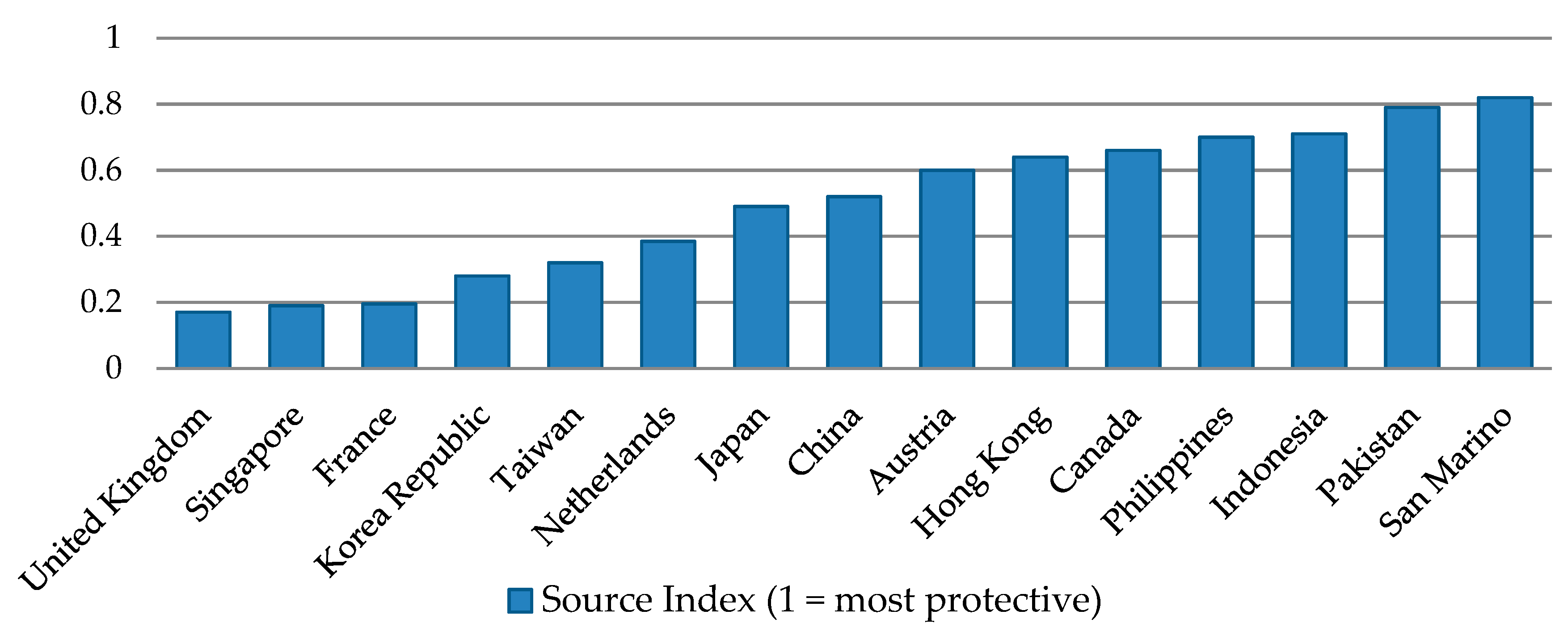

On the flip side the top marginal individual tax rate is 37. Certain tax treaties provide for the withholding tax rate on services and royalties to as low as 5. The agreement is signed to make a country an attractive destination as well as to enable NRIs to take relief from having to pay taxes multiple times.

Tax treaties and some states do not. That means that if a dollar is double-taxed in the US the highest total rate it could see would be 58. In particular non-resident companies that are subject to UK tax on UK-source rental profits see the Taxes on corporate income section for more information will find their letting agent or tenants are obligated to withhold the appropriate tax at source currently 20 without any allowances from their rental payments unless the recipient has.

Fortunately many countries have double tax agreements which usually provide rules to determine which of the two countries can treat you as a resident. This publication is the tenth edition of the full version of the OECD Model Tax Convention on Income and on Capital. As of 2022 the federal income tax rate on corporate profits is 21.

Apply for Power of Attorney Form W-7. The 2010 protocol entered into force on 28 December 2010 and is effective in both countries for tax years from 1 January 2011. 1 Australias income tax treaties are given the force of law by the International Tax Agreements Act 1953The Agreement between the Australian Commerce and Industry Office and the Taipei Economic and Cultural Office concerning the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on Income is a document of less than treaty status.

This section contains information about Irelands Double Taxation Agreements DTAs and Tax Information Exchange Agreements TIEAs. Some states honor the provisions of US. New Zealand has DTAs and protocols in force with.

The eFile Tax App handles all related foreign. Country for purposes of a double tax agreement. Dual Residence Status And Agreements For The Avoidance Of Double Taxation Malaysia has entered into agreements with a number of countries that avoid double taxation by allocating.

Protect against the risk of double taxation where the same income is taxable in 2 states. Education fees Self Other than a degree at masters or doctorate level - Course of study in law accounting islamic financing technical vocational industrial scientific or technology. This full version contains the full text of the Model Tax Convention as it read on 21 November 2017 including the Articles Commentaries non-member economies positions the Recommendation of the OECD Council the historical notes and the.

In addition here are more tools that help you to get answers to many other tax preparation related questions. The Double Tax Avoidance Agreement DTAA is a treaty that is signed by two countries. Multinational companies may request competent authority relief from double taxation through a tax treaty.

The economy of Malaysia is the fourth largest in Southeast Asia and the 34th largest in the world according to the International Monetary Fund. The complete texts of the following tax treaty documents are available in Adobe PDF format. To find out more about DTAs see the role of double tax agreements.

AGREEMENT FOR AVOIDANCE OF DOUBLE TAXATION AND PREVENTION OF FISCAL EVASION WITH AFGHANISTAN Whereas the Government of India and the Government of Afghanistan have concluded an. On this note the double taxation agreement between Malaysia and the United States of America is of limited scope and does not address double tax issues relating specifically to services and royalties. If the tax treaty does not provide a solution or if your situation is particularly complicated contact the tax authorities of one or both countries and ask them to clarify your situation.

Double Tax Agreements In Indonesia

Double Tax Agreements In Indonesia

Jrfm Free Full Text Double Taxation Treaties As A Catalyst For Trade Developments A Comparative Study Of Vietnam S Relations With Asean And Eu Member States Html

Double Tax Agreements In Indonesia

Double Tax Treaties Experts For Expats

Tax Guide For Expats In Malaysia Expatgo

Tax Guide For Expats In Malaysia Expatgo

Double Taxation Agreements In Malaysia Acclime Malaysia

Double Taxation Agreements In Malaysia Acclime Malaysia

Individual Income Tax In Malaysia For Expatriates

What Happens When You Get Your Malaysia Income Tax Audited

Tax Implications On Digital Services Crowe Malaysia Plt

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Pdf The Relationship Between Double Taxation Treaties And Foreign Direct Investment

Payments That Are Subject To Withholding Tax Wt